Identifying the Field to Invest

It was an old twitter thread lying around waiting for me to read. I have this bad habit of keeping hundreds of tabs open and then sit for days clearing them. This one came out of it. So, what’s this one about? You want to invest in field. How do you zero in on that? Or, you have decided to invest in a field. Should you go ahead or should you drop it?

Patrick Campbell gives a four step approach.

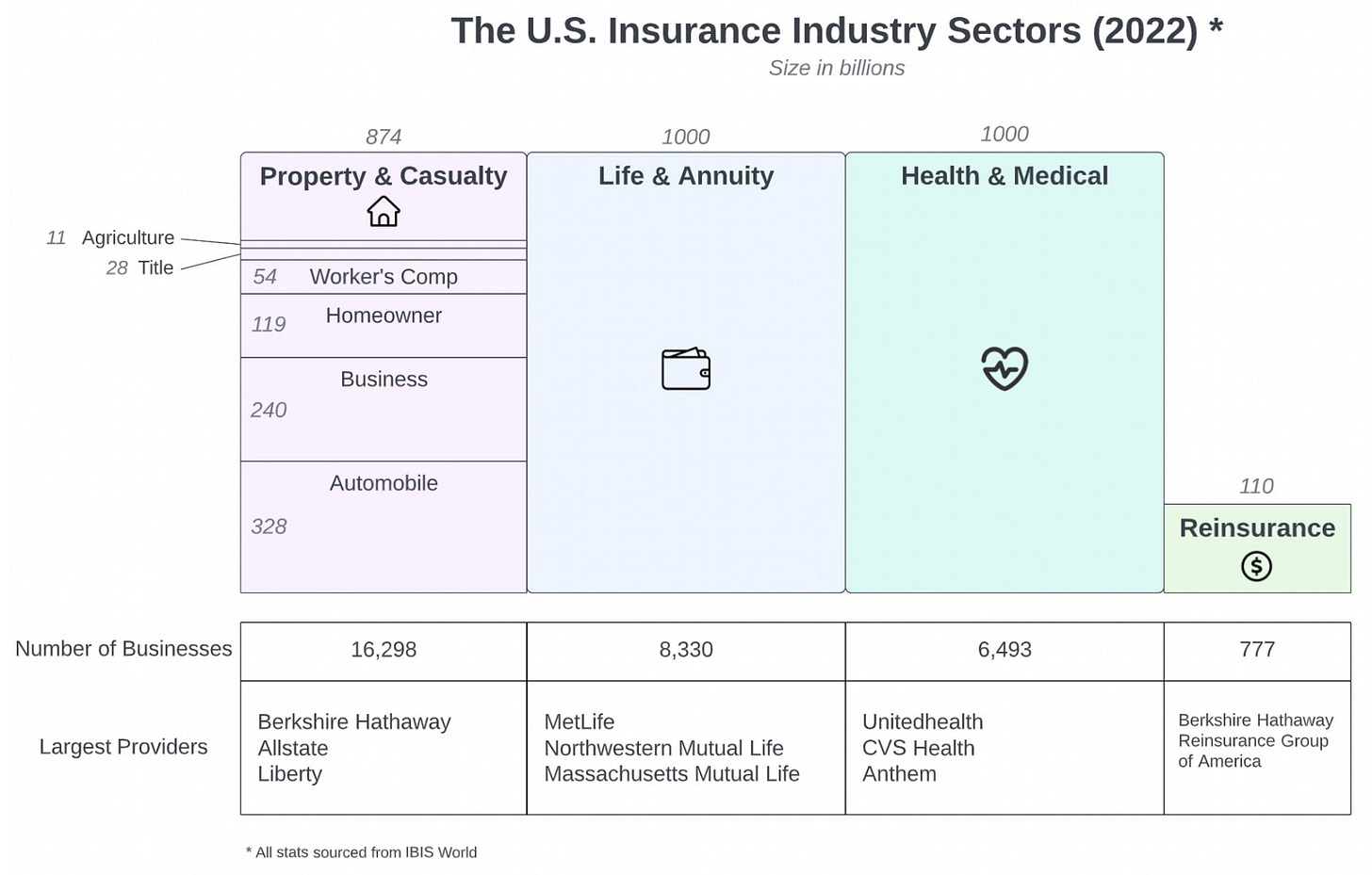

Player Proportion Analysis

Identify the sectors, sub-sectors and their relative sizes.

Identify the total number of players

Identify the biggest players

Now, how do you deal with a field which has one big player and rest fringe? Isn’t it easy for you to be one of the many with not much name, and on the other hand, building up using the mistakes of the large player?

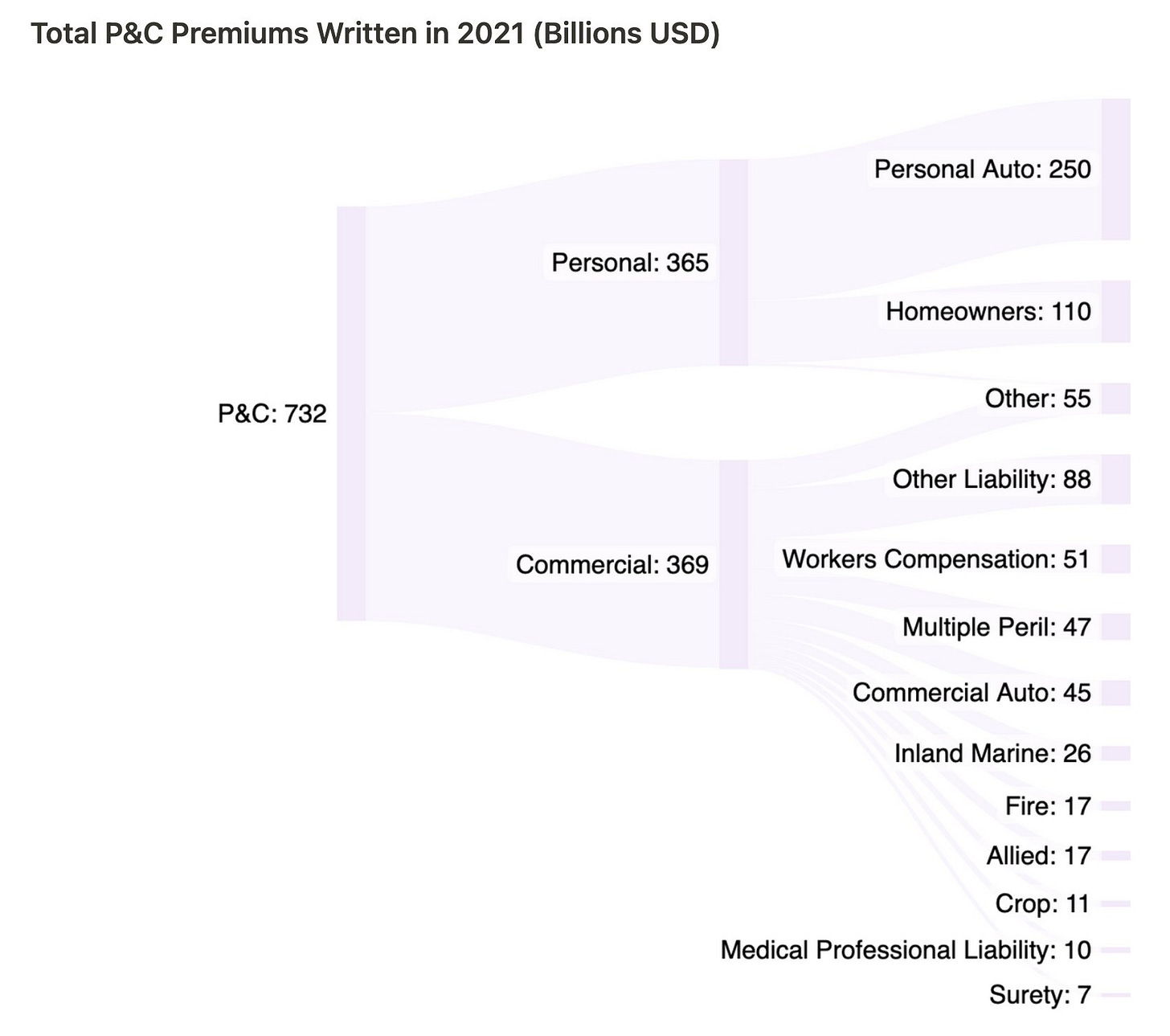

Market Flow Analysis

Try to identify how money flows in the sector through it’s sub-sectors. The aim is to find out both the sub-sectors and the size of them.

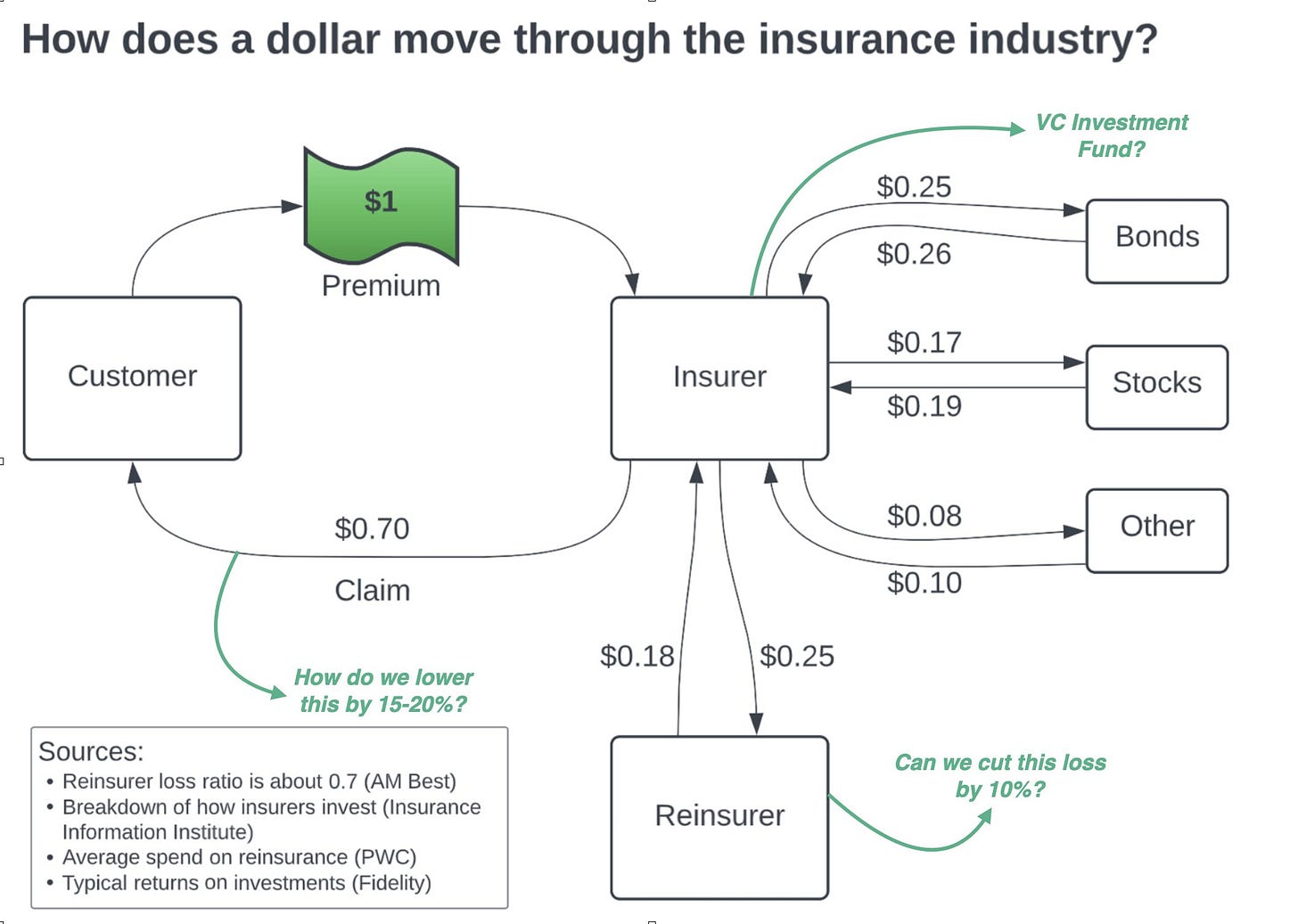

Journey of a Dollar Analysis

Now, how does money circulate in the whole sector? What can you do to rebalance the flow to enhance your margins?

Key Org Chart Analysis

Now, you know the sub-sector and the money flow. Identify the roles in the sub-sector and try to identify what can you do with them to optimize your profits.

Clearly, through this analysis, you will be in a position to identify what the industry is, who are the players and what can you do to optimize your profits. Is it viable or not to invest here is much easier after this analysis.

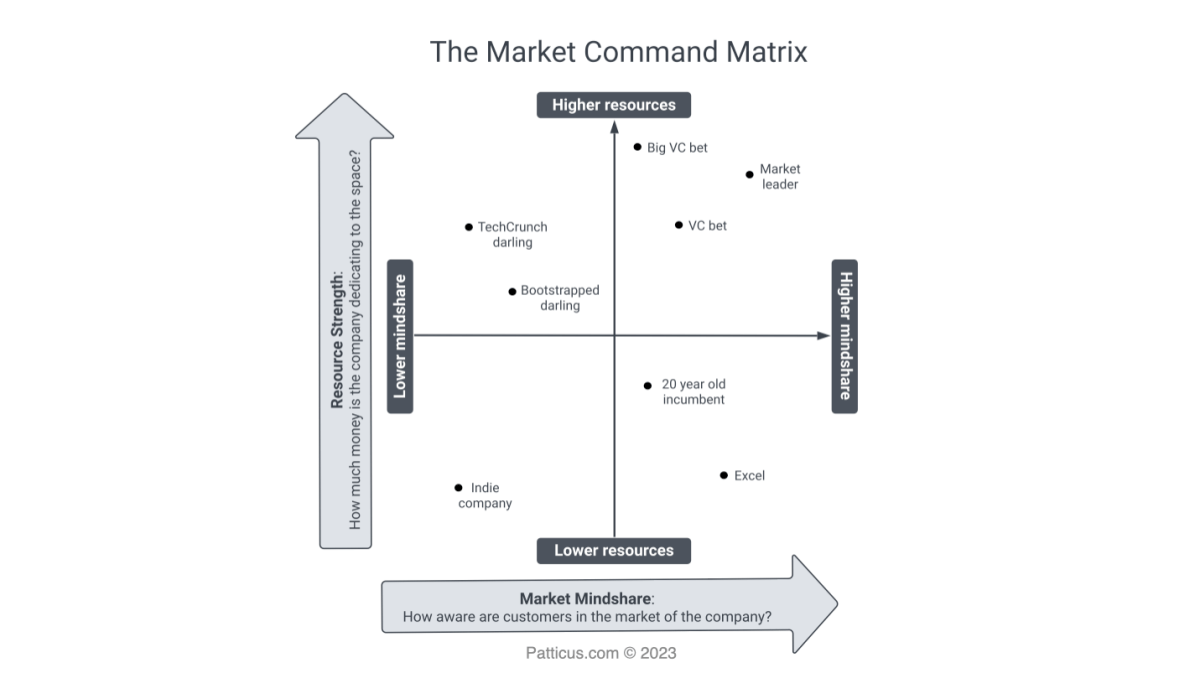

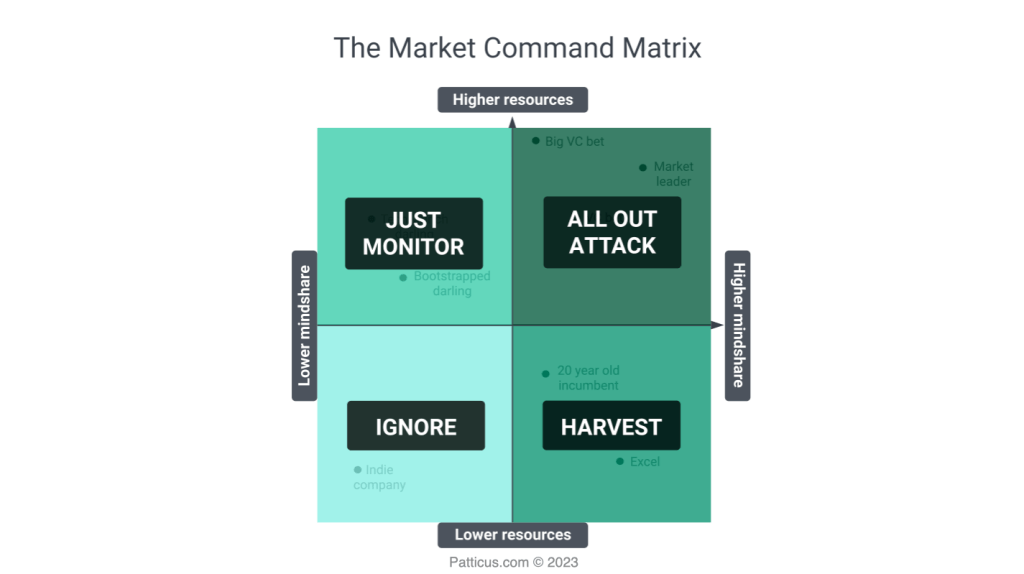

Now, he comes up with something else - the Market Command Matrix.

How do you want to leverage it?

It’s a superb article. Read it.